For those who are new to our “Healthcare Done Differently” blog series, welcome. We are happy you’re here and hope you enjoy learning about ways to lower healthcare costs.

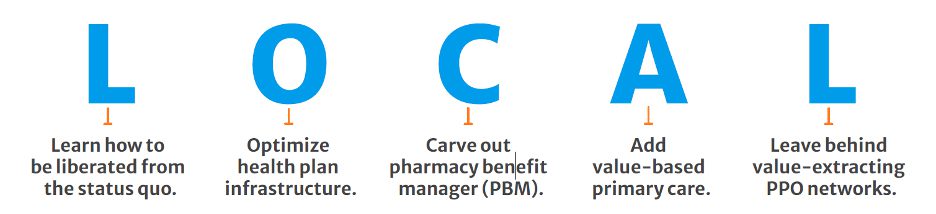

Within this blog series, we focus on unpacking the Health Rosetta principles around health plans being LOCAL. Each step, represented by a letter, helps plan sponsors build a firm foundation to regain control and use common-sense strategies to better manage employee healthcare spend.

Picking up from Step 1, or L, which stands for LEARN how to be liberated from the status quo, covered in our June blog, we will now discuss the “O” for OPTIMIZE health plan Infrastructure and, as a practical application, we highlight a go-to, cost-savings solution from the BCF Group Playbook.

Step 2 is “O” for OPTIMIZE.

So, by now, you are probably asking yourself what “optimizing health plan infrastructure” means. Simply put, it means controlling risk. Risk exists in every aspect of your healthcare plan, from plan design and administration to documentation and compliance; all are areas fraught with risk and potential exposure.

When a company optimizes its health plan infrastructure, it takes an active role in managing any identified risk. Admittedly, it is no small undertaking, but with a little help, leaders in Finance and HR can feel confident that they are taking the necessary steps to reduce risk and ultimately to reduce cost.

Listed below are a few Best Practices that plans can use to optimize health plan infrastructure.

The contracts and plan documents are reviewed by a qualified third party to ensure your plan is fully compliant and optimized to provide the best benefits at the lowest cost.

- Fully compliant ERISA plans protect your plan from abuse.

- All plan and vendor documents are aligned to create a holistic risk-mitigation strategy.

- Stop-loss and underwriting Best Practices are followed to ensure plan assets are protected.

- Smart plan designs encourage members to make smart healthcare decisions.

All plan vendors have aligned incentives to lower health plan costs and improve quality, and you have the tools to oversee the plan and your vendors.

- All vendors have aligned incentives.

- Third-party administration proactively manages claims, payments, and provides complete process transparency.

- Data access and contract terms empower you to oversee, audit, intervene, and improve your plan.

You have access to evidence-based and disease-specific care navigation, pathways, and treatment protocols.

- Second opinions are available at no charge for plan participants.

- Lower complication rates and avoidance of unnecessary procedures drive strong ROI.

- Handoffs between care providers are fully coordinated and clearly defined.

Our BCF Group Playbook

Continuing along the risk-mitigation theme, our BCF Group Playbook is a proprietary risk-management toolbox that contains years of tried-and-true strategies to optimize health plan infrastructure.

One of the most successful tools in our toolbox is the Medicare cost-benefit analysis. The concept behind this tool is to lay the groundwork, wherever possible, to reduce higher-than-average risk in an organization’s group health plan. Stating that someone over the age of 60 has a higher-than-average risk is accurate. As a person ages, they typically incur more healthcare services.

Of course, we know that Medicare is secondary to a Group Health Plan if the sponsoring employer has 20 or more employees, and we also know that offering incentives is strictly prohibited as a means to encourage Medicare-eligible plan participants to drop group coverage and enroll in Medicare.

For someone who is already Medicare eligible or who is approaching age 65, the Medicare cost-benefit analysis will compare your organization’s group benefits and costs with Medicare Parts A, B, C, and D. More often than not, this exercise will demonstrate savings for the employee and, in turn, translate into savings for you, the employer. In cases where the analysis does not show savings, you have accomplished two important things:

- The employee will feel cared for at a time when their options can be confusing.

- As the plan sponsor, you have taken the necessary steps to mitigate risk where possible.

To learn more about charting a new path forward for your employer-sponsored health plan, we encourage you to continue reading our Healthcare Done Differently blog series. Next, we’ll dive into the “C” for CARVE out your pharmacy benefit manager (PBM) within Health Rosetta’s LOCAL 5-step continuum and touch on another go-to, cost-savings solution from the BCF Group Playbook.