Financial instability is regularly a top-of-mind concern every business works hard to avoid. From insurance coverage to best practices, ensuring nothing threatens the ability to stay open and provide for employees.

Oftentimes, businesses purchase insurance to assure financial stability in the event of a disaster. Typically, the largest risk a business faces is its commercial auto liability with their fleet of vehicles on the road. Obviously, any business that has a fleet of vehicles is going to have insurance in case an accident does occur. However, what they often don’t know or prepare for is the abject financial devastation an at-fault accident can have if their liability limit is insufficient to settle a claim. Once this limit is exhausted, the business’s remaining assets and future income can be lost in expensive and potentially ruinous litigation.

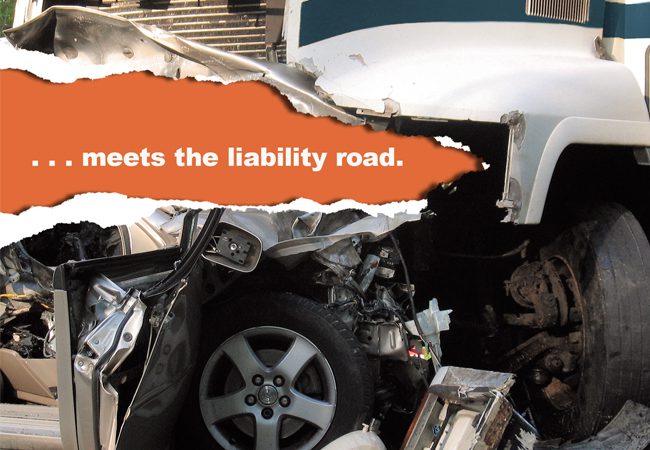

The truth is, a split-second accident can destroy your business that took years, a lifetime, or even generations to build in the blink of an eye.

That being said, you are not alone. Every business with a fleet faces this same exposure. It’s even logical to think you are totally fine simply because you have a commercial auto policy.

With appropriate auto liability limits, if an accident does occur, coverage ensures you have the funds available to settle a claim leaving your business’s assets intact and giving you the ability to focus on what matters most—your business.

What kind of coverage and limit is appropriate?

We recommend you consider the following:

- Commercial auto policy with the maximum auto liability limit the insurance company offers (typically $1 million)

- Umbrella coverage, which provides additional liability coverage on top of the underlying auto policy (typically offered in million-dollar increments)

- Reviewing limits with your agent to determine what is appropriate based on cost of coverage and overall exposure your business faces.

At the end of the day, your business’s ability to stay open and provide an income for you and your employees depends on financial solvency. Don’t let a split-second auto accident destroy your business due to an inadequate auto liability limit.

If you have any questions, do not hesitate to reach out.